Jasper Finance & Tax

Lindsey Williams began her career with the City of Jasper as a Utility Billing Clerk in 2006. Since then, she has moved to the position of Finance Director.

Ms. Williams completed the Leadership Pickens Program in 2009 and the Certified Local Government Finance Officer Level 1 Program with the Carl Vinson Institute in 2020.

Ms. Williams resides in Fairmount with her husband and children. In her spare time, she enjoys baking and spending time with family.

OPERATING BUDGETS

2024 Adopted Budget picture_as_pdf 2023 Adopted Budget picture_as_pdf 2022 Adopted Budget picture_as_pdf 2021 Adopted Budget picture_as_pdf 2020 Adopted Budget picture_as_pdf 2019 Adopted Budget picture_as_pdf 2018 Adopted Budget picture_as_pdf 2017 Adopted Budget picture_as_pdf 2016 Adopted Budget picture_as_pdf 2014 Budget Amendment picture_as_pdf 2015 Adopted Budget picture_as_pdf 2014 Adopted Budget picture_as_pdf 2013 Adopted Budget picture_as_pdf 2012 Adopted Budget picture_as_pdf 2011 Adopted Budget picture_as_pdf 2010 Adopted Budget picture_as_pdf

FINANCIAL REPORTS

CY 2022 Financial Report picture_as_pdf CY 2021 Financial Report picture_as_pdf CY 2020 Financial Report picture_as_pdf CY 2019 Financial Report picture_as_pdf CY 2018 Financial Report picture_as_pdf CY 2017 Financial Report picture_as_pdf CY 2016 Financial Report picture_as_pdf CY 2015 Financial Report picture_as_pdf CY 2014 Financial Report picture_as_pdf CY 2013 Financial Report picture_as_pdf CY 2012 Financial Report picture_as_pdf CY 2011 Financial Report picture_as_pdf CY 2010 Financial Report picture_as_pdf CY 2009 Financial Report picture_as_pdf CY 2008 Financial Report picture_as_pdf

FORMS

Business / Occupational Tax License picture_as_pdf

Print Form and submit with payment to:

City of Jasper

Attn: Occupation Tax

200 Burnt Mountain Rd.

Jasper GA, 30143

Hotel-Motel Tax Form picture_as_pdf

Print Return and submit with payment to:

City of Jasper

Attn: Tax Department

200 Burnt Mountain Rd.

Jasper GA, 30143

AD VALOREM TAX RATES & EXEMPTIONS

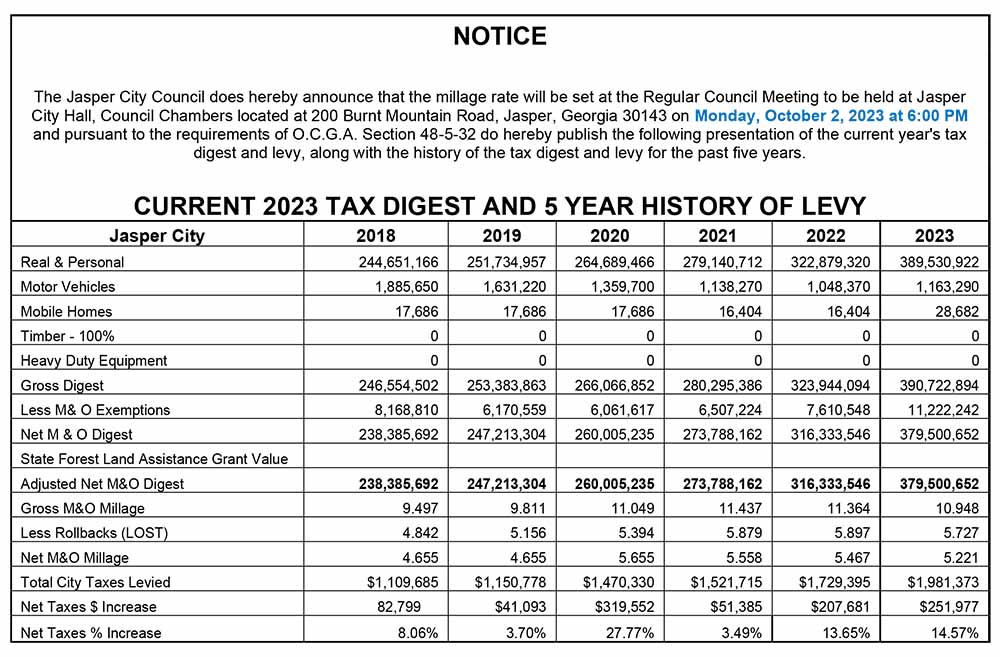

NOTICE: CURRENT 2023 TAX DIGEST AND 5 YEAR HISTORY OF LEVY

The Jasper City Council does hereby announce that the millage rate will be set at the Regular Council Meeting to be held at Jasper City Hall, Council Chambers located at 200 Burnt Mountain Road, Jasper, Georgia 30143 on Monday, October 2, 2023 at 6:00 PM and pursuant to the requirements of O.C.G.A. Section 48-5-32 do hereby publish the following presentation of the current year's tax digest and levy, along with the history of the tax digest and levy for the past five years.

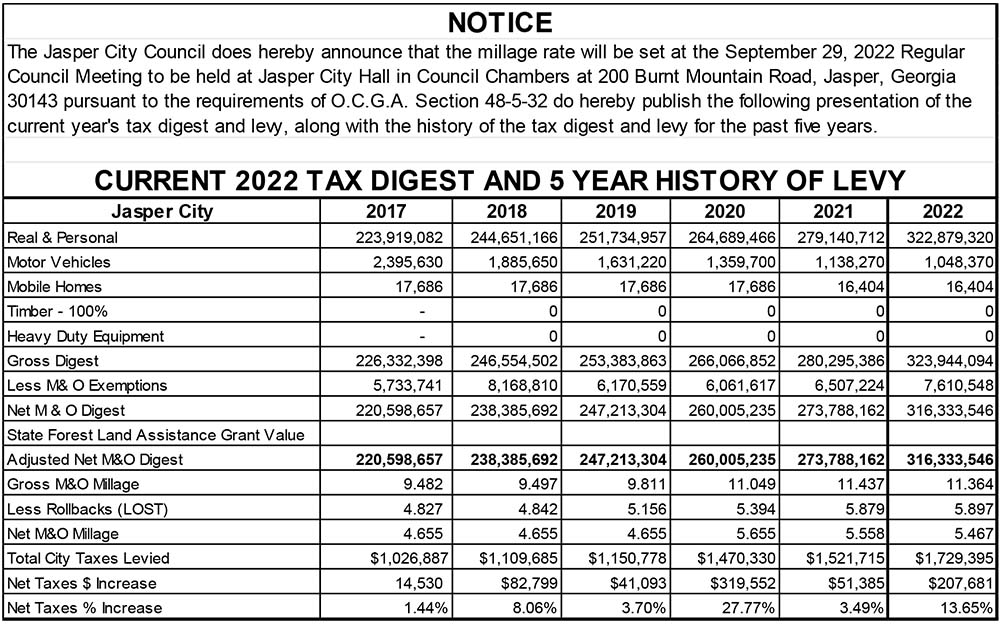

CURRENT 2022 TAX DIGEST AND 5 YEAR HISTORY OF LEVY

Current Tax Rate

Millage Rate 5.467 mills

2021 PROPERTY TAX BILLS

2021 Property Tax Bills for the City of Jasper will be mailed on Friday, November 12, 2021. Payments are due January 31, 2022. Payments may be made online at municipalonlinepayments.com/jasperga. Mortgage companies have been notified that tax bills are now available, however please forward your notice to your mortgage company if your taxes are paid in escrow.

Please contact Lindsey Williams at lwilliams@jasper-ga.us, Ashley Tuneburg at atuneburg@jasper-ga.us or Jessica Dawkins at jdawkins@jasper-ga.us for any Property Tax questions.

City Exemptions

Homestead Exemption $3000

Hometead Exemption for Citizens 65 yrs and older $4000

Ad-Valorem Due Date: January 31, 2022

Mail Ad Valorem Tax Payments to:

City of Jasper

Attn: Ad Valorem Tax Dept

200 Burnt Mountain Rd.

Jasper GA, 30143

Please include the bill number on the check.