Jasper Finance & Tax

OPERATING BUDGETS

2026 Adopted Budget picture_as_pdf 2025 Adopted Budget picture_as_pdf 2024 Amended Budget picture_as_pdf 2024 Adopted Budget picture_as_pdf 2023 Adopted Budget picture_as_pdf 2022 Adopted Budget picture_as_pdf 2021 Adopted Budget picture_as_pdf 2020 Adopted Budget picture_as_pdf 2019 Adopted Budget picture_as_pdf 2018 Adopted Budget picture_as_pdf 2017 Adopted Budget picture_as_pdf 2016 Adopted Budget picture_as_pdf 2014 Budget Amendment picture_as_pdf 2015 Adopted Budget picture_as_pdf 2014 Adopted Budget picture_as_pdf 2013 Adopted Budget picture_as_pdf 2012 Adopted Budget picture_as_pdf 2011 Adopted Budget picture_as_pdf 2010 Adopted Budget picture_as_pdf

FINANCIAL REPORTS

CY 2024 Financial Report picture_as_pdf CY 2023 Financial Report picture_as_pdf CY 2022 Financial Report picture_as_pdf CY 2021 Financial Report picture_as_pdf CY 2020 Financial Report picture_as_pdf CY 2019 Financial Report picture_as_pdf CY 2018 Financial Report picture_as_pdf CY 2017 Financial Report picture_as_pdf CY 2016 Financial Report picture_as_pdf CY 2015 Financial Report picture_as_pdf CY 2014 Financial Report picture_as_pdf CY 2013 Financial Report picture_as_pdf CY 2012 Financial Report picture_as_pdf CY 2011 Financial Report picture_as_pdf CY 2010 Financial Report picture_as_pdf CY 2009 Financial Report picture_as_pdf CY 2008 Financial Report picture_as_pdf

FORMS

Business / Occupational Tax License picture_as_pdf

Print Form and submit with payment to:

City of Jasper

Attn: Occupation Tax

200 Burnt Mountain Rd.

Jasper GA, 30143

Hotel-Motel Tax Form picture_as_pdf

Print Return and submit with payment to:

City of Jasper

Attn: Tax Department

200 Burnt Mountain Rd.

Jasper GA, 30143

AD VALOREM TAX RATES & EXEMPTIONS

2026 BUDGET PUBLIC HEARING & ADOPTION

The Mayor and City Council of the City of Jasper’s recommended budget for 2026 is available for public review beginning November 13, 2025 at Jasper City Hall located at 200 Burnt Mountain Road in Jasper - Monday through Friday, 8:00 a.m. to 5:00 p.m. and on-line on the City of Jasper’s website at www.jasper-ga.us. CLICK HERE TO REVIEW THE PROPOSED BUDGET picture_as_pdf

The Mayor and City Council will conduct a public hearing to obtain citizen comments regarding the recommended budget on Thursday, November 20, 2025, beginning at 6:00 p.m. – at Jasper City Hall – 200 Burnt Mountain Road Jasper, Georgia 30143. The public is invited to attend and participate in this public hearing.

The Mayor and City Council will consider adopting the 2026 budget by resolution at a regular council meeting on Monday, December 1, 2025, at 6:00 p.m. The meeting will be held at Jasper City Hall located at 200 Burnt Mountain Road, Jasper, GA 30143. The public is invited to attend and observe this public meeting.

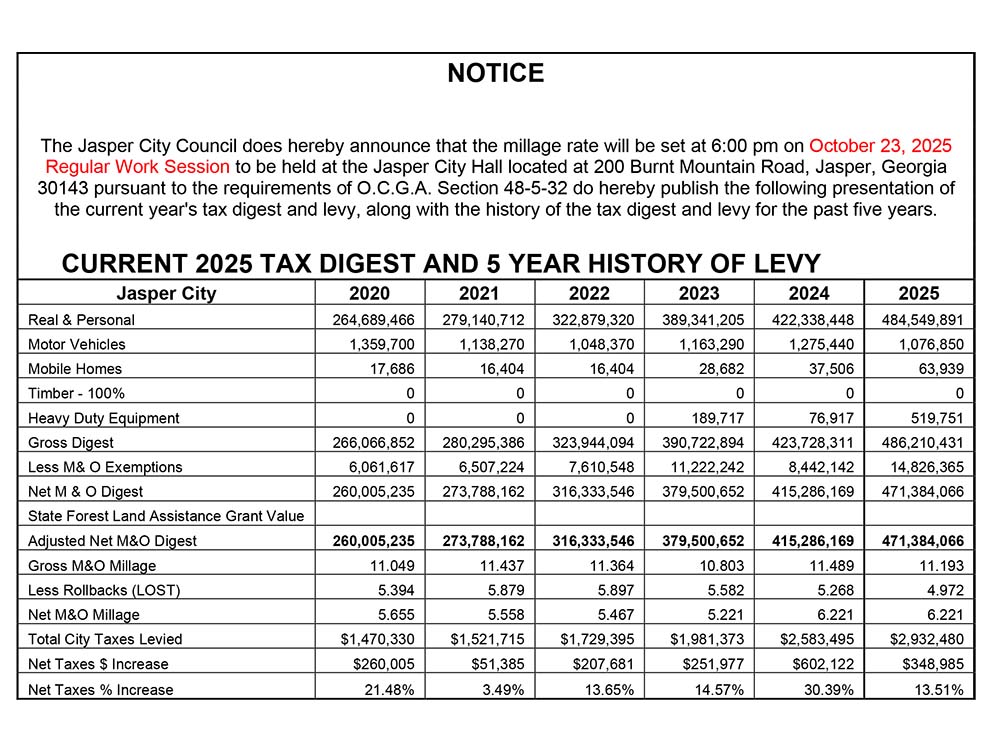

NOTICE OF PROPERTY TAX INCREASE CITY OF JASPER

The Council Members of the City of Jasper have tentatively adopted a millage rate which will require an increase in property taxes by 1.39 percent.

All concerned citizens are invited to Public Hearings on this tax increase to be held at Jasper City Hall, 200 Burnt Mountain Road, Jasper, GA 30143 on October 6, 2025, at an administrative hearing at 10:00 AM and 5:30 PM before the Regular Scheduled Council Meeting before the Mayor and Council in the Council Chambers.

An additional Public Hearing on this tax increase will be heard in the Council Chambers at Jasper City Hall, 200 Burnt Mountain Road, Jasper, GA 30143 on October 23, 2025, at 6:00 PM. Consideration and adoption of the millage rate will be heard subsequently at the Regular Scheduled Work Session at 6:00 PM on October 23, 2025.

This tentative increase will result in a millage rate of 6.221 mills, an increase of 0.085 mills. Without this tentative tax increase, the millage rate will be no more than 6.136 mills. The proposed tax increase for a home with a fair market value of $175,000 is approximately $0.00 and the proposed tax increase for non-homestead property with a fair market value of $350,000 is approximately $0.00.

IMPORTANT ADDITIONAL

INFORMATION NOTICE TO TAXPAYERS

CITY INCREASING MILLAGE RATE

According to Georgia law, all taxing agencies must advertise a tax increase and hold three public hearings to claim taxes on reassessed properties even if the millage rate remains unchanged. The City of Jasper has tentatively adopted a millage rate of 6.221 mills which is the same millage rate as 2024. However, it is higher than the rollback rate of 6.136 mills. The tentative millage rate for 2025 is 6.221. This millage rate is 1.39% higher than the rollback millage rate of 6.136.

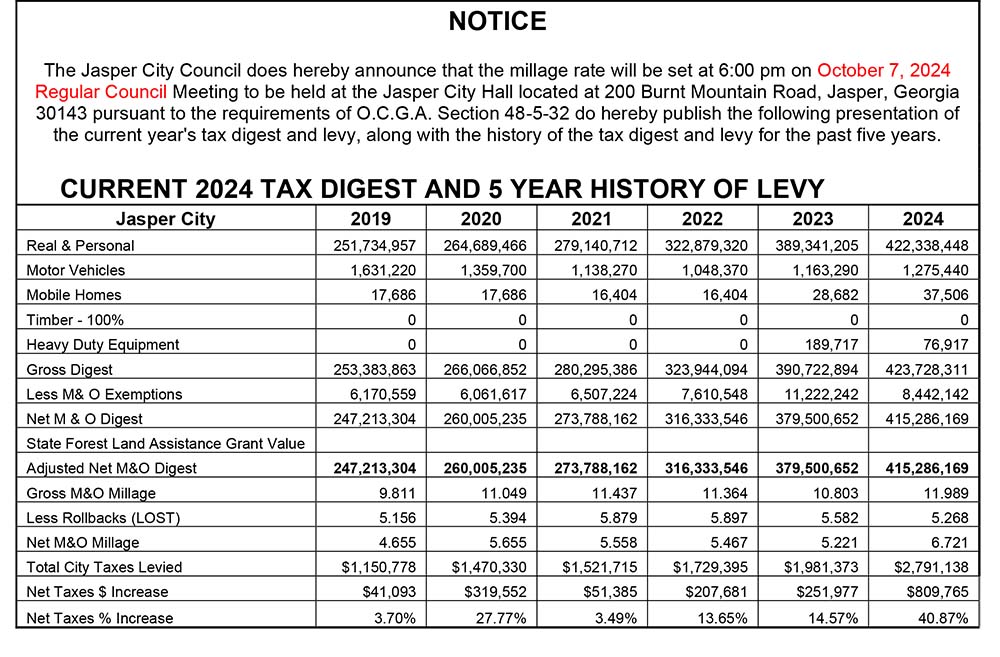

CURRENT 2024 TAX DIGEST AND 5 YEAR HISTORY OF LEVY

Current Tax Rate

Millage Rate 6.721 mills

PROPERTY TAX

Payments may be made online at municipalonlinepayments.com/jasperga.

Please contact Lindsey Williams at lwilliams@jasper-ga.us or Jessica Dawkins at jdawkins@jasper-ga.us for any Property Tax questions.

City Exemptions

Homestead Exemption $3000

Hometead Exemption for Citizens 65 yrs and older $4000

Ad-Valorem Due Date: February 2, 2025

Mail Ad Valorem Tax Payments to:

City of Jasper

Attn: Ad Valorem Tax Dept

200 Burnt Mountain Rd.

Jasper GA, 30143

Please include the bill number on the check.

Lindsey Williams

FINANCE DIRECTOR

email lwilliams@jasper-ga.us

Lindsey Williams began her career with the City of Jasper as a Utility Billing Clerk in 2006. Since then, she has moved to the position of Finance Director.

Ms. Williams completed the Leadership Pickens Program in 2009 and the Certified Local Government Finance Officer Level 1 Program with the Carl Vinson Institute in 2020.

Ms. Williams resides in Fairmount with her husband and children. In her spare time, she enjoys baking and spending time with family.